Challenges of Qualifying Vendors for Clinical Trials: How Diligent Pharma Streamlines and Accelerates Vendor Qualification

Research Report

December 2022

Authors: Julie Neild and Ian Macholl

Contributors: Jay Turpen and Claudia Cernea

Vendor qualification continues to increase in importance due to a growth in clinical development services,1 protocol and operational complexity,2,3 and innovations such as decentralized technology.4,5,6 Vendor qualifications conducted before contract signing inform companies about a prospective vendor’s ability to meet regulatory requirements and organization standards once under contract.

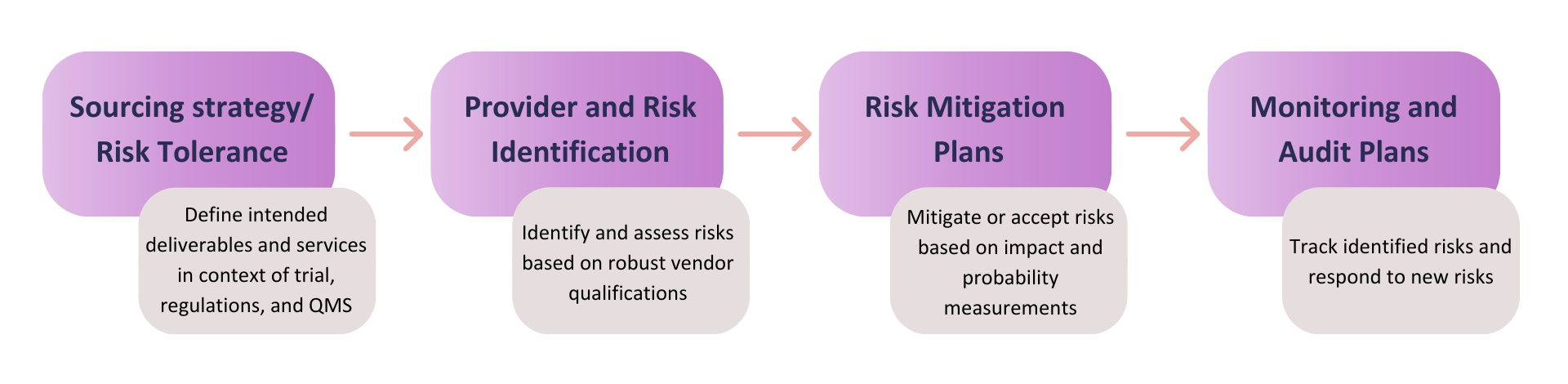

Vendor qualifications that are viewed as part of one continuous value chain (Figure 1) help to minimize clinical development risks, improve operational performance, and speed clinical development cycle times.7 However, while vendor qualification is a global regulatory requirement in the outsourcing process [ICH GCP E6(R2) and ICH Q10], applying the dynamic requirements in an environment of increased demand requires substantial investments of both time and resources for sponsors and vendors alike.8,9

Demand Grows for Qualifying Vendors

- Biotech and pharmaceutical industry sponsors continue to increase the outsourcing of clinical development services to vendors with an expected CAGR growth of 9.56% during 2022-2027.1

- The average number of procedures in phase 2 and phase 3 clinical trials has increased 44% since 2009.3

- Decentralized or hybrid trials increased 50% from 2020 to 2021, and a 28% increase is expected from 2021 to 2022.4,5,6

Figure 1: Vendor qualification as part of the overall risk-management framework in clinical trials

Enhancing Regulatory Compliance Through Standardization

Biopharmaceutical companies demonstrate substantial variability in the domain areas assessed during vendor qualification. A study by Tufts Center for the Study of Drug Development reported 24 areas of general inquiry were assessed during VQAs. However, large companies routinely assessed only 50% of these areas on each VQA.8,9 Areas routinely assessed include data privacy protection provisions, quality management systems, document management and control, and 21 CFR part 11 compliance. Customization typically occurred with new capabilities of interest such as biomarkers and data analytics. With so much variability in the areas assessed, service providers are unable to execute vendor qualifications efficiently and consistently.

The global regulatory landscape is also constantly evolving. Changes impact the entire drug development lifecycle and include monitoring, electronic systems, and data integrity [eg, ICH GCP E6(R2) and planned ICH GCP E6(R3)]. Without a comprehensive surveillance of the regulatory landscape, trial sponsors risk cycle time delays, increased costs, and other clinical development issues caused by noncompliance.

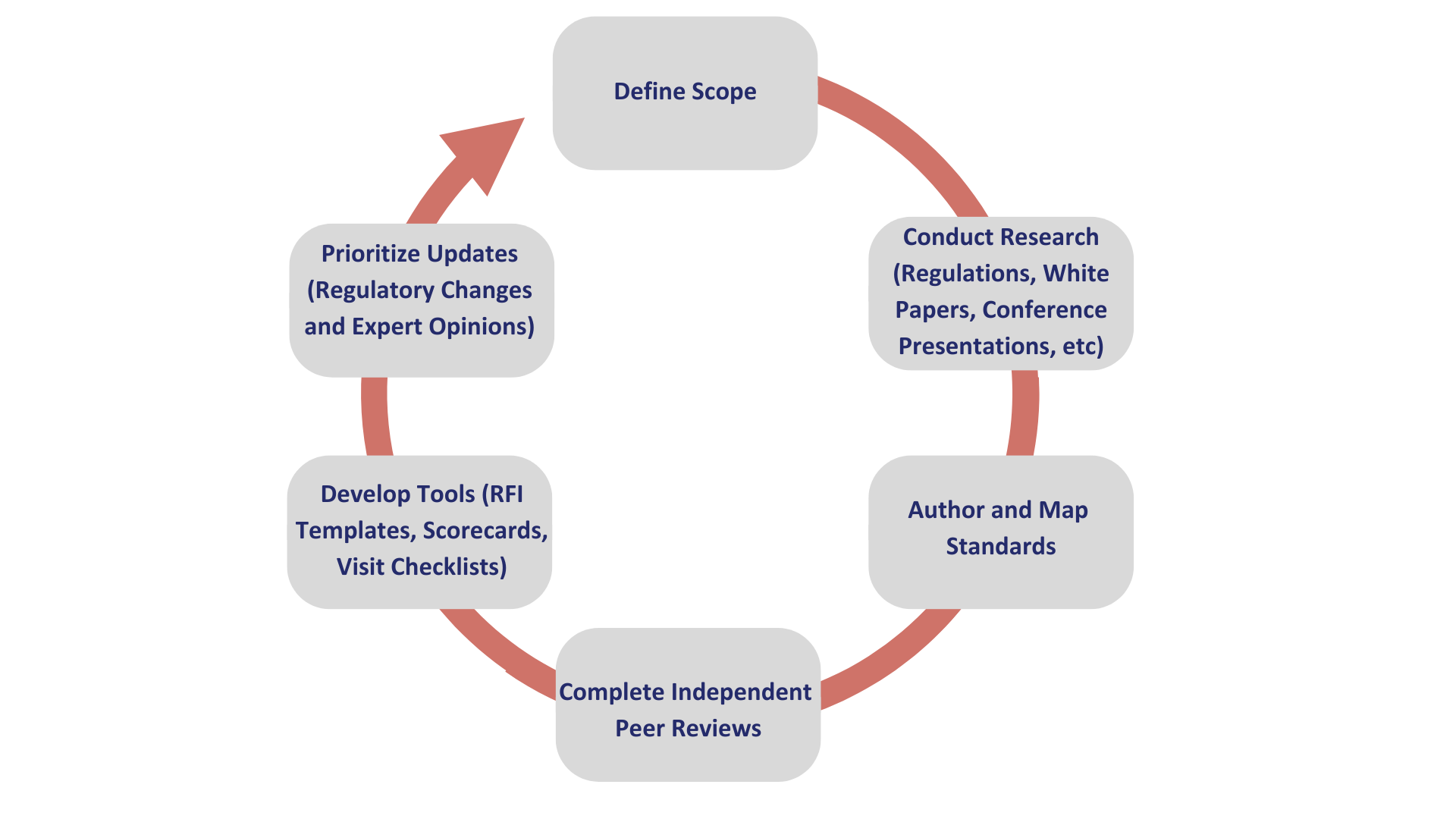

WCG Avoca® Quality Consortium (AQC) developed a standardized, comprehensive approach to manage the risks of outsourced services more efficiently and effectively in clinical trials (Figure 2). Peer-reviewed provider qualification standards and tools are developed and maintained as part of a formalized process that starts with a needs analysis and prioritizes updates based on regular change control.

Figure 2: WCG Avoca® Quality Consortium (AQC) process to develop and maintain provider qualification standards. Diligent Pharma leverages these standards and tools during vendor assessments.

Reducing Costs by Improving Cycle Times and Managing Resources

Shorten Timelines

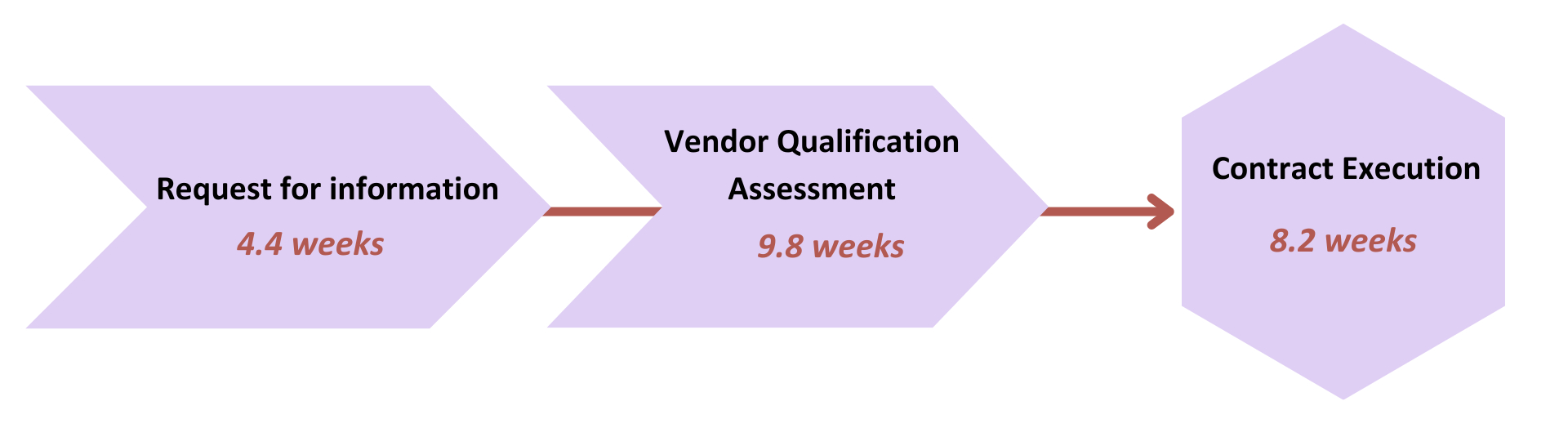

The rapid development of emerging scientific approaches, new assays, and decentralized technologies presents challenges to companies qualifying new vendors for clinical trials. Once companies select potential vendors based on their sourcing strategy and risk tolerance, the process of gathering foundational information in a Request for Information (RFI) qualification questionnaire, completing a more formal auditor-led Vendor Qualification Assessment (VQA), and executing a contract can take 4 to 6 months (Figure 3).8,9 Re-qualification activities are only marginally faster, saving 2 to 4 weeks.8

Figure 3: Overall average cycle times for vendor qualification.9

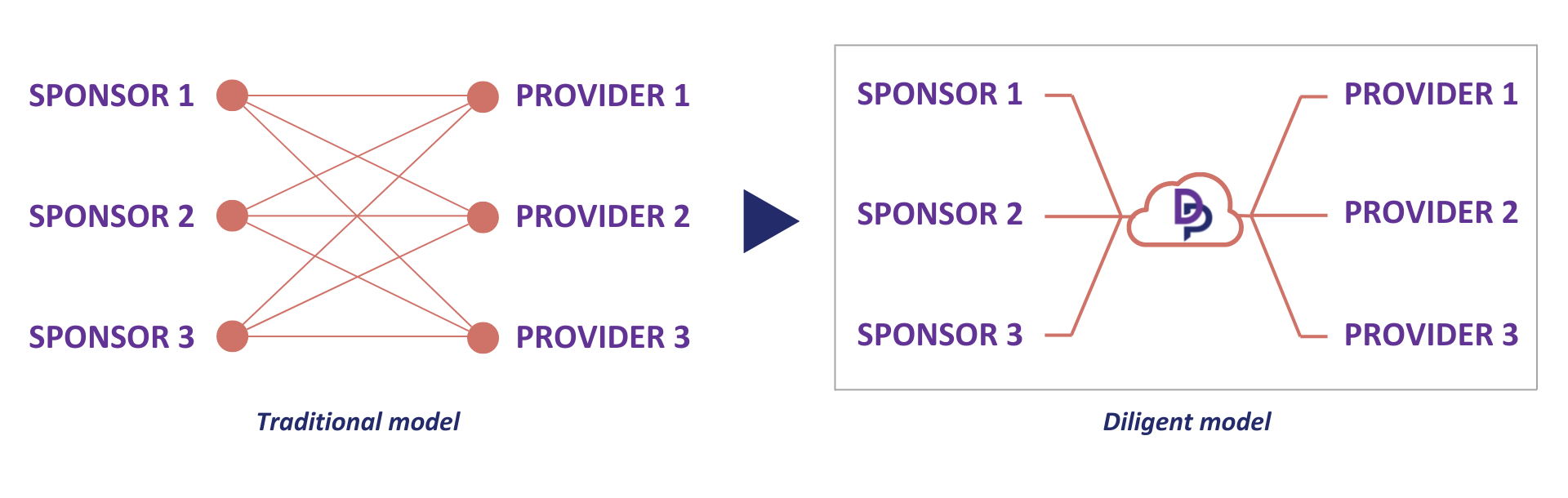

Traditionally, every sponsor qualifies every vendor, and the process is repeated from sponsor to sponsor, which requires vendors to complete multiple qualifications for similar work (Figure 4).

Figure 4: Traditional model vs Diligent model for qualifying vendors.

Leveraging the industry-leading AQC provider qualification standards, Diligent Pharma10 assesses a vendor on request by a sponsor using RFI questionnaires or a VQA visit. A vendor can also proactively complete Diligent’s core RFI questionnaire as well as any specific RFI questionnaires that relate to the services offered by the vendor.

Once the responses from the RFI qualification questionnaire are received and/or the VQA report is complete, the information is held in a cloud-based platform so other sponsors can rapidly access the same details (Figure 4). Vendors only need to respond to an RFI once, which can then be accessed by multiple trial sponsors.

The online platform allows sponsors to search and even compare different vendors to develop a shortlist of selected vendors based on normalized standards. By reusing content, both sponsors and vendors save time and resources. Diligent currently has over 320 completed RFIs for over 130 service providers available on the platform. Anonymized VQA reports are also available on the platform, or a sponsor can request to participate in upcoming VQAs. When existing Diligent RFIs or VQA reports are available, the vendor qualification cycle time is shortened to a few days.

Cycle Times Vary Between Sponsors and CROs

- Sponsor companies take nearly 5 months on average to complete the process for a new single-service provider and nearly 7 months for a new provider that is providing multiple services.8

- CROs are substantially faster at completing the process, decreasing the cycle time by 35% to 45%.8

Focus Internal Resources on Core Competencies

In 2018, global drug developers spent US $375 million to perform 25,000 vendor qualifications and re-qualifications, with larger companies completing an average of 86 vendor qualifications annually.8 CROs bear the greatest cost burden spending on average 3 times as much as sponsors to complete VQAs annually. These costs do not include the indirect resource costs associated with vendor qualification.

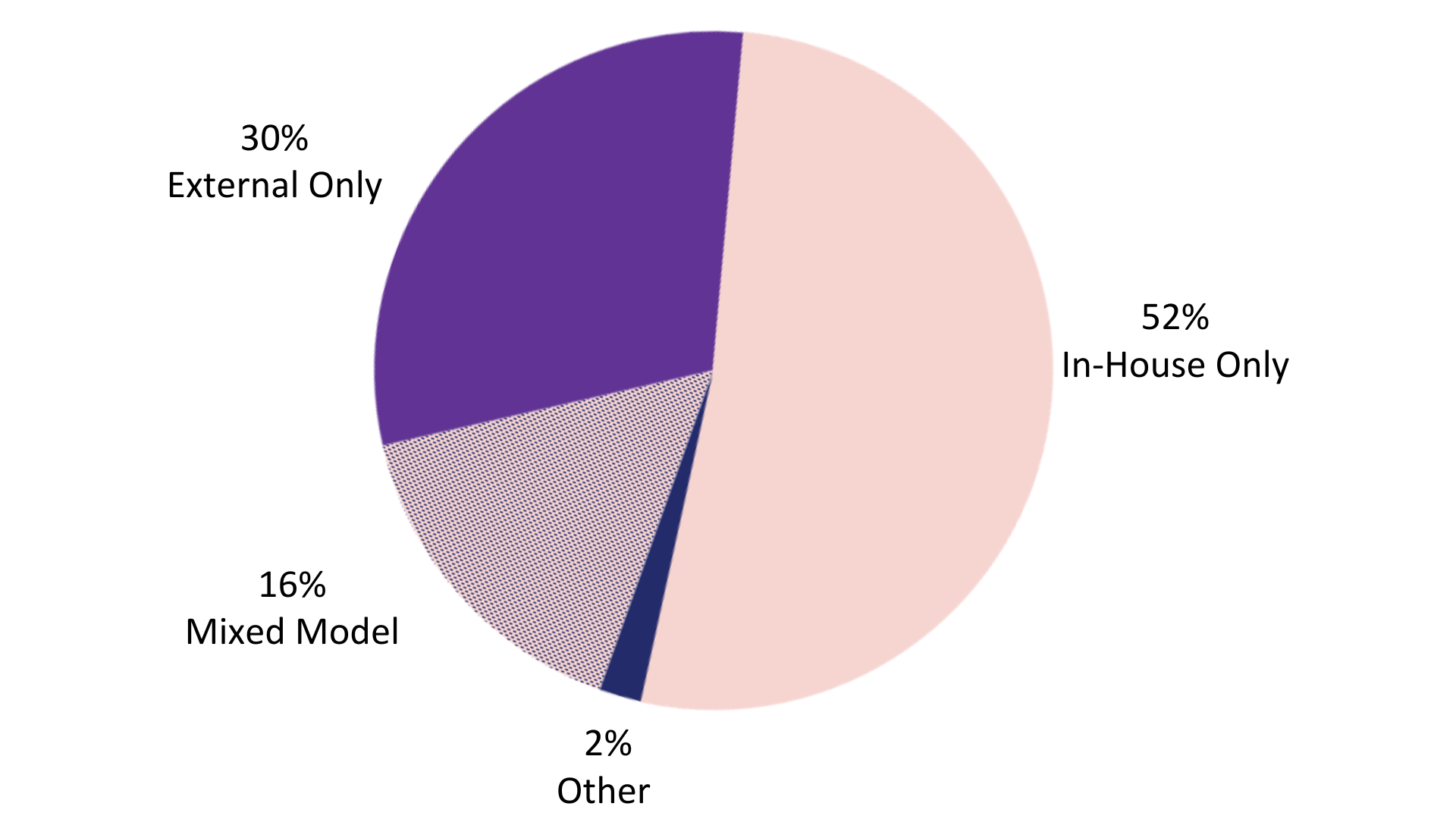

Companies rely on different sources to perform qualification activities (including in-house teams and a mixed model)11 (Figure 5). Large companies devoted an average of 27.7 full-time equivalents (FTEs) to perform VQAs in 2018 with each FTE completing an average of 3.1 VQAs. CROs were more than twice as efficient as their sponsor counterparts performing 7.6 VQAs/FTE. Vendors also are given a heavy burden preparing for and hosting VQAs. An ever-expanding 2000+ pharmaceutical and biotech companies are evaluating a significant number of new vendors out of the rapidly increasing 4000+ vendors providing clinical development services.9 Vendors may be asked to host different sponsors requesting the same services resulting in duplicate work. At any company, these human resources may be better directed to activities that contribute to a competitive advantage for the organization.

Figure 5: How pharmaceutical and biotech companies qualify vendors.11

Diligent’s technology platform and quality assurance and auditing services allow sponsors to dedicate their internal resources to activities that are of the highest value. When a new RFI is requested, Diligent approaches the service providers, issues RFI questions, manages the progress, and reviews responses. Sponsors can also request a risk scoring of selected provider RFI responses based on the risk profile of the clinical trial. This allows sponsors to avoid a lengthy analysis of all RFI responses and focus their assessment of a vendor on areas of highest risk.

During VQAs, a global network of experienced quality auditors leverages the provider qualification standards. If CAPAs are identified, Diligent can also manage the CAPA resolution process to assist the trial sponsor.

Vendor Qualifications Require Substantial Cost and Resources

- The average cost for each qualification of a new vendor ranges from US $12,607 at small companies to US $21,839 at larger companies.9

- A large CRO may host more than 250 vendor qualifications per year – on average 1 every working day.9

Conclusion

The demand for vendor qualification will continue to grow as companies outsource more clinical development services. However, the high-level regulatory requirements established in ICH GCP E6(R2) and ICH Q10 lack guidance on how to implement these requirements in a fit-for-purpose fashion for individual companies. Trial sponsors as well as service providers invest substantial time and resources to support the high and growing volume of vendor qualifications and re-qualifications each year. The Diligent Qualification Platform offers a new approach with improved efficiencies for both sponsors and providers by using standardized RFI questionnaires and VQA reports to reduce the time and resources needed for vendor qualification.

References

- ReportLinker. Pharma R&D Outsourcing Market – Global Outlook & Forecast 2022-2027. https://www.reportlinker.com/p06320993/Pharma-R-D-Outsourcing-Market-Global-Outlook-Forecast.html. Published September 2022. Accessed December 12, 2022.

- Getz K, Campo R. Trends in clinical trial design complexity. Nat Rev Drug Discov. 2017;16:307. doi:10.1038/nrd.2017.65

- Tufts Center for the Study of Drug Development (CSDD). Rising protocol design complexity is driving rapid growth in clinical trial data volume, according to Tufts Center for the Study of Drug Development [press release]. https://f.hubspotusercontent10.net/hubfs/9468915/TuftsCSDD_June2021/pdf/Rising+Protocol+Design+Complexity+is+Driving+Rapid+Growth+in+Clinical+Trial+Data+Volume.pdf Published January 12, 2021. Accessed December 12, 2022.

- Parkins K, Hillman A. 2022 forecast: decentralized trials to reach new heights with 28% jump. Clinical Trials Arena. https://www.clinicaltrialsarena.com/analysis/2022-forecast-decentralised-trials-to-reach-new-heights-with-28-jump/. Published December 14, 2021. Accessed December 12, 2022.

- Lamberti MJ, et al. The impact of decentralized and hybrid trials on sponsor and CRO collaborations. Appl Clin Trials. https://www.appliedclinicaltrialsonline.com/view/the-impact-of-decentralized-and-hybrid-trials-on-sponsor-and-cro-collaborations. Published July 27, 2022. Accessed December 12, 2022.

- Diligent Pharma. Managing risk in eClinical technologies and decentralized clinical trials (DCTs) [on-demand webinar]. https://www.diligentpharma.com/webinar-managing-risk-eclinical-technologies-decentralized-clinical-trials-may-2022/. Published May 10, 2022. Accessed November 17, 2022.

- Otto C. Prequalification provider assessments shouldn’t be seen in isolation [interview]. Diligent Pharma. https://www.diligentpharma.com/prequalification-provider-assessments-should-not-be-seen-in-isolation/. Published September 2022. Accessed December 12, 2022.

- Getz K. Untapped opportunity to improve the vendor qualification process. Appl Clin Trials. 2020;29(3). https://www.appliedclinicaltrialsonline.com/view/untapped-opportunity-improve-vendor-qualification-process. Published March 1, 2020. Accessed December 12, 2022.

- Turpen J. Clinical development vendor qualification: “check-the-box” exercise? Contract Pharma. https://www.contractpharma.com/issues/2020-03-01/view_features/clinical-development-vendor-qualification-check-the-box-exercise. Published March 4, 2020. Accessed December 12, 2022.

- Diligent Qualification Platform. https://www.diligentpharma.com/. Accessed December 12, 2022.

- Diligent Pharma. Identifying risks for outsourced services a novel approach to provider qualification [on-demand webinar]. https://www.diligentpharma.com/identifying-risks-for-outsourced-services-oct-2022/. Published October 4, 2022. Accessed December 12, 2022.